Index

5.1 Determining Business Viability

5.2 Pricing Decisions

5.3 Investor Readiness

5.4 Forecasting

6.1 When CAC > LTV

6.2 When CAC < LTV

1. Introduction

With the startup boom in India, it becomes evident for every entrepreneur to not only master their product but to master their finances as well. However, most startups fail in India due to a lack of understanding of their business finances. This is where Unit Economics comes into the picture.

As the name suggests, Unit Economics is the view of the business at a granular level. It is a method used to evaluate a business’s profitability on a per-unit basis by analysing the cost and revenues linked to each unit. A “unit” can be a product, service or a customer.

For example, for an app-based cab booking startup, several trips booked by one user in a month will show customer traction. For an online D2C business, average order value per customer and repeat rate might be more relevant.

Let us look at some of the key metrics used to measure business performance.

2 Customer Acquisition Cost (CAC)

In the competitive landscape of modern business, understanding how much it costs to acquire a customer is crucial for sustainable growth. This metric, known as Customer Acquisition Cost, provides insights into the efficiency of a company’s marketing and sales efforts.

- Includes all costs like social media advertising, referral programs, salaries and commissions, promotional events and discounts offered.

- Best tool to assess the effectiveness of marketing strategies where the initial layout is high.

- Lower CAC with high sales signifies solid market demand and strong brand presence.

- Higher CAC signifies a misaligned go-to-market strategy or a saturated market.

CAC = Total Marketing Spend / Unique Customers Acquired

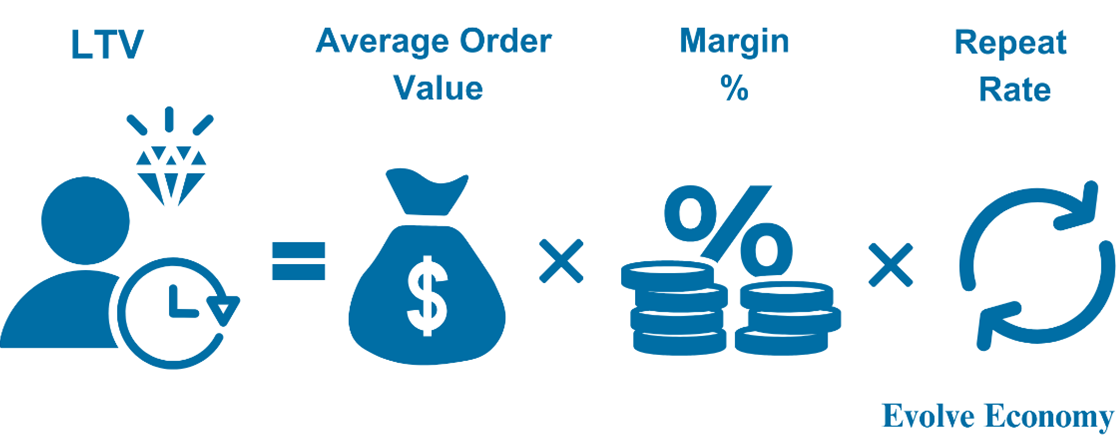

3. Customer Lifetime Value (CLV/LTV)

It’s a proven fact that businesses that can deliver superior products and retain customers in the long term can grow faster than businesses that don’t. A key metric to assess customer retention is calculating their lifetime value. LTV is a powerful metric that helps businesses predict the total revenue a customer will generate throughout their entire relationship with the company.

- Can be calculated for individual customers or a segment of customers.

- Helps in identifying high-value customers and orienting marketing strategy towards them.

- High CLV indicates strong product acceptance and brand credibility.

- Low CLV indicates product substitution ability, strong competitor’s presence or low demand.

LTV = Average Revenue from Customer X Gross Margin Ratio X Repeat Rate

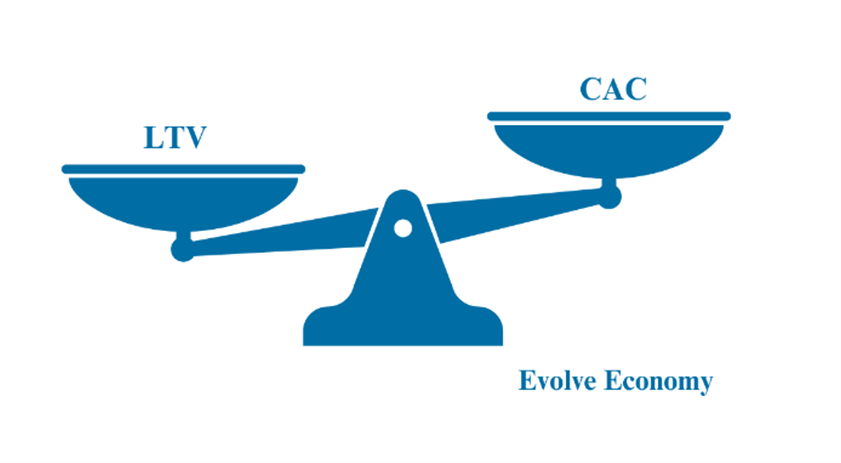

4. LTV/CAC Multiple

Simply put, this ratio measures returns generated from one customer over the cost incurred to acquire the customer. The class of customers that have higher LTV/CAC multiple will generate higher value for businesses over some time.

A ratio greater than 1 indicates that the value gained from a customer outweighs the cost of acquiring them.

Higher LTV/CAC multiple may not be relevant at times when customers hold strategic importance rather than just financial.

This ratio is not reflective of the timing gap that might be there between the acquisition cost incurred and the value realised from customers

Generally, an LTV/CAC ratio of 3:1 and above is considered better.

5. Why is it important to assess Unit Economics

Unit Economics decodes the entire business model into a simplistic equation at a granular level. The very foundation of the business, when pictured at per unit level, gives a holistic view of the business model, its sustainability and its scalability.

Below are some reasons why every business should evaluate its unit economics.

5.1 Determining Business Viability

Unit economics helps a business understand its drivers and cost structure, which further helps in decision-making and profitability.

Example

If the cost to acquire a customer (CAC) exceeds the revenue generated (Customer Lifetime Value), it signals that adjustments are necessary to ensure long-term viability.a

5.2 Pricing Decisions

Unit economics can reveal whether a product is priced appropriately or if there’s room for optimisation.

Example

If the CLV of the product is higher with lower CAC, it means that customers perceive the product as premium, and there is room for increasing the price.

5.3 Investor Readiness

Investors generally prefer unit economics that demonstrate a company’s potential for profitability and scalable growth.

Example

Businesses exhibiting high volume growth with minimal CAC vouches for scalability and attracts investors.

5.4 Forecasting

Unit economics help businesses understand the impact on per unit future profitability with any change in its drivers.

Example

Analysing the relationship between CAC and CLV helps in identifying sustainable marketing expenditure and building forecasts around the same.

6.How to turn around your business using Unit Economics

It is key to understand how unit economics can be put to use to derive meaningful insights for your business. Let’s take a look at some of the scenarios that businesses might face and what they indicate about the financial health of a business.

6.1 When CAC > LTV

- It is an unfavourable situation for every business to be in.

- It signifies that every penny incurred on acquiring a customer is generating lower value than cost incurred (Negative ROI).

- Reasons for higher acquisition cost could be inappropriate product-market fit and channel strategy or strong competition.

- The business needs to evaluate the reason for their higher burn and take corrective action.

- Evaluating channel-wise marketing ROI and eliminating negative/low ROI channels can help in improving the CAC.

6.2 When CAC < LTV

- It is a favourable situation for every business.

- It signifies that the business is generating higher returns from every penny it is spending to acquire customers (Positive ROI).

- However, the returns should be significantly higher to justify the cost of capital. A marginal return won’t make up for the same.

- Calculating the same at channel level and diverting funds towards the channel which generates higher returns can set the business on path for higher profitability.

- There should be reasonable assurance around all the costs getting accounted for while calculating the unit economics.

At Evolve Economy, we help businesses decode unit economics, optimise costs, and drive sustainable financial growth.

Get in touch with us to build a financially sound and scalable business model!