Index

1. Introduction

This oversight can have significant consequences:

- Misplaced investments in underperforming products

- Poor pricing strategies

- Inefficient capital deployment

- Strategic decisions based on volume, not value

2. Product Profitability: The Hidden Growth Metric

In the looming times of rising costs, capital constraints, and changing demand, relying on revenue alone is a risky bet. A product may sell well, but that doesn’t mean it’s profitable. Without visibility into profitability, teams may unknowingly scale products that drain resources. It helps product teams make smarter, data-informed decisions:

- Should we invest more in this product?

- Can it be optimized for better margins?

- Is it time to sunset it?

True growth doesn’t come from more products. It comes from more profitable products. Businesses that understand this build for resilience—not just scale.

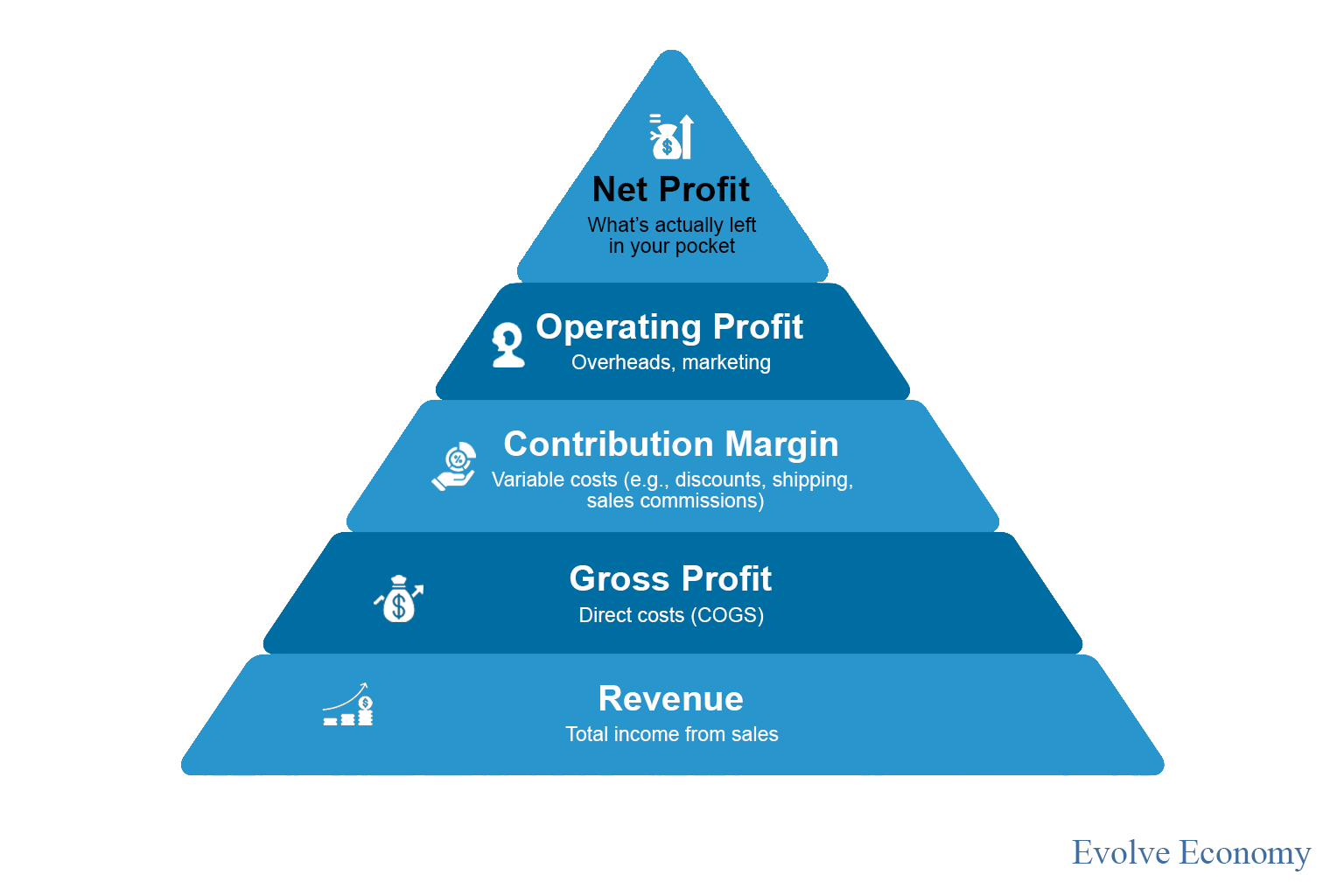

3. Revenue vs Profit

High revenue can be deceptive. What matters is how much of that revenue converts to sustainable profit.

- Revenue is the total income generated from sales.

- Gross Profit subtracts direct costs (COGS) from revenue.

- Contribution Margin further removes variable expenses.

- Net Profit is what remains after all fixed, indirect, and opportunity costs.

Understanding these distinctions helps leaders avoid scaling products that are popular but unprofitable. It also ensures better alignment between growth and sustainability.

4. India’s Startups and SMEs

India currently boasts over 63 million MSMEs, contributing nearly 30% to the national GDP and employing more than 110 million people. Initiatives like Startup India, Atmanirbhar Bharat, and Digital MSME have created fertile ground for entrepreneurial growth.

“Many startups burn through capital focusing on scale, not sustainability. The result? Growth without viability.” — SIJSS, 2023

This tendency to prioritize customer acquisition and GMV (gross merchandise value) over gross and contribution margins has led to premature collapses—even in seemingly successful businesses. For these ventures, knowing which product is truly profitable could mean the difference between survival and extinction.

5. Key Metrics That Uncover Real Profitability

To truly assess product profitability, companies must measure and track:

- Gross Margin per Product: Revenue minus direct costs

- Contribution Margin: Profit after variable costs

- Customer-Level Profitability: Revenue versus total cost to serve

- CAC vs. LTV: Are we acquiring customers who generate profitable lifetime value?

- Net Margin per SKU: After allocating all overhead, fixed, and indirect costs

These metrics reveal the true health of each product, beyond topline excitement.

6.Strategic Use Cases of Product Profitability

What needs to be done:

- Discontinue: Cut products that consistently lose money.

- Bundle: Combine low-margin with high-margin items to improve average profitability.

- Smart Pricing: Even a small discount on a low-margin product can eliminate profits entirely.

- Redesign or Reposition: Adapt or refine products with poor margins to align with better use cases.

- Margin-Based Selling: Train sales and product teams to prioritize upselling based on profit profiles.

These are not just tactical tweaks. They are strategic moves backed by margin clarity.

7. Margin Intelligence

Raw numbers aren’t enough—data must drive decisions. This is where Margin Intelligence helps. The analysis helps identify:

- Price vs. volume drivers

- Products with rising sales but falling profitability

- High-maintenance customers who cost more to serve than they return

By classifying products into:

- Profit Leaders: Scale aggressively

- Profit Laggards: Improve or reengineer

- Value Destroyers: Consider phasing out

Businesses gain precise control over where and how they allocate resources. This is the heart of operational profitability—taking what is known and acting on it with precision.

8. Benchmarking Product Performance

No product metric lives in a vacuum. Benchmarking allows businesses to understand performance in context—both internally and against industry standards.

- Internal Benchmarks:

- Which SKUs yield the highest cost-to-revenue ratios?

- What is the average lifecycle margin across categories?

- External Benchmarks (e.g., Amplitude):

- Is your ARPU (Average Revenue per User) aligned with industry norms?

- Are CAC levels sustainable compared to competitors?

- How do retention rates influence your margin trajectory?

Benchmarking doesn’t just showcase excellence—it uncovers hidden drag points affecting the bottom line.

9. Profit-Informed Value Propositions

Great products don’t just solve customer problems—they generate returns. A compelling value proposition must go beyond features and storytelling. It must be rooted in financial logic.

- A profit-aligned value proposition::

- Pinpoints what the customer truly values

- Differentiates based on offerings that can be profitably sustained

- Supports viable unit economics

- With this approach, businesses can::

- Invest in what delivers sustainable value

- Avoid distraction from unprofitable pursuits

- Build lasting brand equity from within their profit core

This is where strategy meets sustainability.

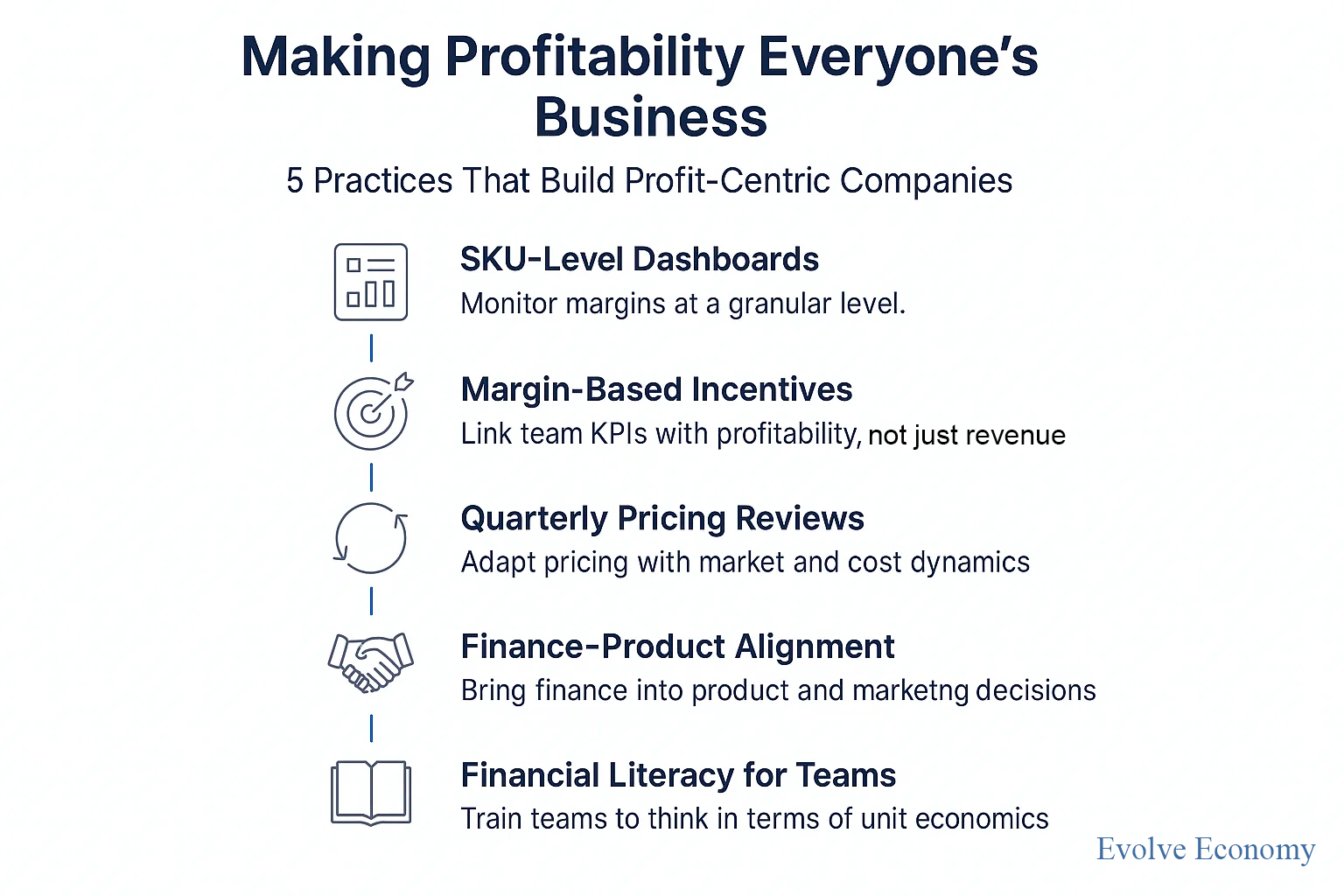

10. The Way Forward: Making Profitability a Core Operating Principle

Founders, product leads, and strategists must treat product profitability as a foundational operating discipline:

- SKU-Level Dashboards: Monitor gross, contribution, and net margins in real time

- Margin-Based Incentives: Align team KPIs with profitability, not just volume

- Cross-Functional Integration: Bring finance into marketing and product discussions

- Quarterly Pricing Reviews: Stay agile with pricing in response to market dynamics

- Financial Training for Teams: Encourage economically informed product thinking

Profit-oriented businesses are better equipped to weather volatility and outperform peers in the long run.

11. Conclusion: From Blind Growth to Informed Scalability

“Growth without profitability is noise”

True scalability stems from deeply understanding and nurturing what pays. With shifting markets and scarce capital, the winners will be those who know not just how to grow, but how to grow profitably making it the modus operandi for companies turning the heads towards the philosophy- Profitability isn’t the end goal, It’s the foundation.