1. Introduction

Profitability is the backbone of any sustainable business, yet it often takes a backseat to the race for revenue growth and market dominance. In times of high valuations and aggressive expansion, many companies lose sight of a fundamental truth: consistent profitability is the only reliable measure of long-term success.

A company might generate impressive revenue figures, but if costs spiral out of control, financial instability becomes inevitable. Revenue represents the total earnings from sales and services, but it doesn’t reflect the reality of operational expenses, taxes, or hidden costs—factors that can make or break a business.

Unlike revenue, profitability is a direct reflection of how efficiently a company transforms income into sustainable financial gains. It’s what allows businesses to remain competitive, adaptable, and resilient, even in volatile markets. When leaders prioritize profitability, they create enterprises that don’t just grow fast—they grow smart.

2.Revenue vs. Profit: The Fundamental Distinction

Understanding the difference between revenue and profit is essential to assessing the health of a business. Revenue, or top-line income, refers to the total money generated from sales of goods or services. Profit, on the other hand, is the bottom-line result—the actual earnings that remain after all expenses are deducted.

Let’s break this down into layers of profitability:

Profit |

Formula |

What it means |

|---|---|---|

|

Gross Profit |

Formula: Revenue – Cost of Goods Sold (COGS) |

This figure shows how efficiently a business produces and delivers its offerings. It reflects direct cost control and pricing strategies. |

|

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) |

Revenue – Operating Expenses (excluding Depreciation and Amortization) or |

EBITDA measures a company’s core operational profitability by excluding non-operational expenses like interest, taxes, and non-cash charges (depreciation and amortization). It provides a clearer view of operating performance, especially useful for comparing companies across industries or capital structures. |

|

Operating Profit (EBIT) |

Formula: Gross Profit – Operating Expenses |

This stage includes costs such as salaries, rent, logistics, and marketing. It is a strong indicator of the efficiency of day-to-day business operations. |

|

Net Profit |

Formula: Operating Profit – depreciation– Taxes – non operating expenses |

This is the ultimate measure of financial success. It reveals what is left for reinvestment, shareholder distribution, or retained earnings. |

It’s entirely possible for a business to post high revenues but remain unprofitable due to escalating overheads or flawed financial planning. For example, a food delivery startup might achieve ₹100 crore in annual revenue but incur ₹120 crore in marketing, logistics, and discounting costs, resulting in net losses despite apparent growth.

Understanding these levels of profit allows stakeholders to diagnose inefficiencies, optimize operations, and build a more sustainable enterprise.

3.Economic and Opportunity Costs in Strategic Decision-Making

Opportunity cost is the value of the next best alternative that is foregone when a particular decision is made. For instance, if a company invests ₹50 lakh into developing Product A but could have achieved greater margins or faster market penetration with Product B, the lost potential of Product B is the true cost of that decision.

Consider a SaaS company choosing between entering a crowded CRM market or developing a niche analytics tool for healthcare providers. The financial outlay for both might be the same, but the long-term strategic value and margin potential could differ dramatically.

Great businesses calculate not just the cost of action, but also the cost of inaction. They continually evaluate capital allocation, workforce deployment, and strategic pivots through the lens of potential return and missed opportunities.

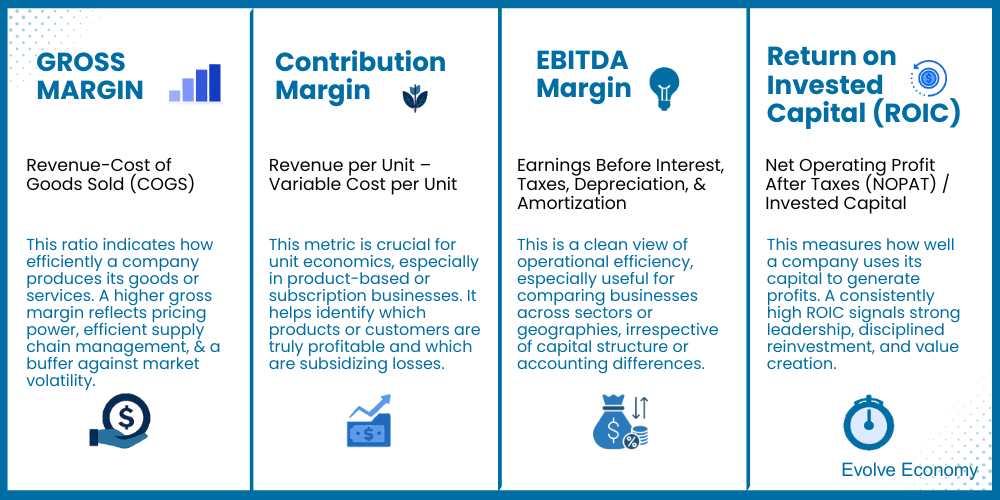

4. Profitability Metrics That Shape Strategy

To effectively steer toward profitability, organizations must move beyond surface-level metrics and embrace a deeper set of analytical tools. Here are key profitability metrics that inform high-quality decision-making:

Metrics |

What it Means |

|---|---|

|

Gross Margin |

Formula: Revenue−Cost of Goods Sold (COGS) |

|

Contribution Margin |

Formula: Revenue per Unit – Variable Cost per Unit |

|

EBITDA Margin |

Earnings Before Interest, Taxes, Depreciation, and Amortization |

|

|

Formula: Net Operating Profit After Taxes (NOPAT) / Invested Capital |

These metrics not only highlight current performance but also uncover opportunities for margin improvement, cost reduction, and smarter strategic investments.

5. Why Profitability is a Strategic Imperative

Profitability isn’t just about financial gain—it’s about creating a business model that is sustainable. Here’s why organizations must centre profitability in their strategic planning:

-

Informed Resource Allocation

With a profitability mindset, companies prioritize high-margin segments and discontinue underperforming products, channels, or geographies. Capital is deployed with precision. -

Sustainable Growth

Profitable businesses rely less on external funding, reducing exposure to market shocks and investor expectations. They retain greater control and independence. -

Operational Discipline

A focus on the bottom line fosters continuous improvement—whether through automation, vendor renegotiation, lean staffing, or performance-based incentives. -

Long-Term Resilience

In downturns or competitive disruption, profitable companies can weather storms better. They maintain cash reserves, preserve talent, and double down on innovation when rivals retrench.

Amazon, for instance, operated on thin margins for years, but its internal profitability measures such as contribution margin and free cash flow enabled it to reinvest strategically and become one of the most resilient businesses globally.

Leaders must shift their lens—from chasing scale at any cost to building a profitable, scalable, and resilient enterprise. Profitability is the foundation on which economy can thrive trickling the benefit to the underserved. As global markets mature and investors demand sustainable returns, companies that prioritize profitability will not only survive—they will lead.