Index

4.1 Problem

4.2 Solution

4.3 Actionable

5.1 Problem

5.2 Solution

5.3 Actionable

6.1 Problem

6.2 Solution

6.3 Actionable

7.1 Problem

7.2 Solution

7.3 Actionable

8.1 Problem

8.2 Solution

8.3 Actionable

1. Introduction

The growth in the Indian hotel industry has been surging post-COVID-19 due to rising tourism. Currently fragmented between large branded chains and small hotel groups, this industry is projected to grow at a CAGR of 4.73% between 2024 and 2029, as per IBEF.

While the growth prospects look promising, the real challenge comes from the segmented nature of the industry, which challenges its growth-harnessing potential. As per the data shared by hospitality consultancy firm Hotelivate, India would need to add another 94,000 branded hotel rooms by FY29, over its current capacity of 192,000, highlighting the importance of branding in this industry. As per research released by Mordor Intelligence, only 28% of the industry is currently captured by branded hotel chains, leaving the small hotel owners with a larger chunk of the playground to conquer.

The small hotel industry stands unorganised with limited focus on branding due to resource and financial constraints. In such a scenario, the key to success for small hotel owners is carving out their brand by identifying gaps that big hotel chains fail to fill. This blog attempts to explore some key metrics that should be tracked by small hotels and strategies to be adopted for branding, differentiation and sustainable growth.

2. Key Metrics in the Hotel Industry

Every industry has key performance metrics that reflect its overall health. In the hotel industry, tracking these metrics is even more crucial, as it helps improve operational efficiency and maximize the recovery of fixed costs.

Metric |

Description |

Key Factors Influencing the Metric |

|---|---|---|

|

Occupancy Rate |

|

|

|

Average Daily Rate |

|

|

|

Revenue Per Available Room (RevPAR) |

|

|

|

Total Revenue per Available Room |

|

|

|

Cost per Operating Room |

|

|

|

Gross Operating Profit per Available Room |

|

|

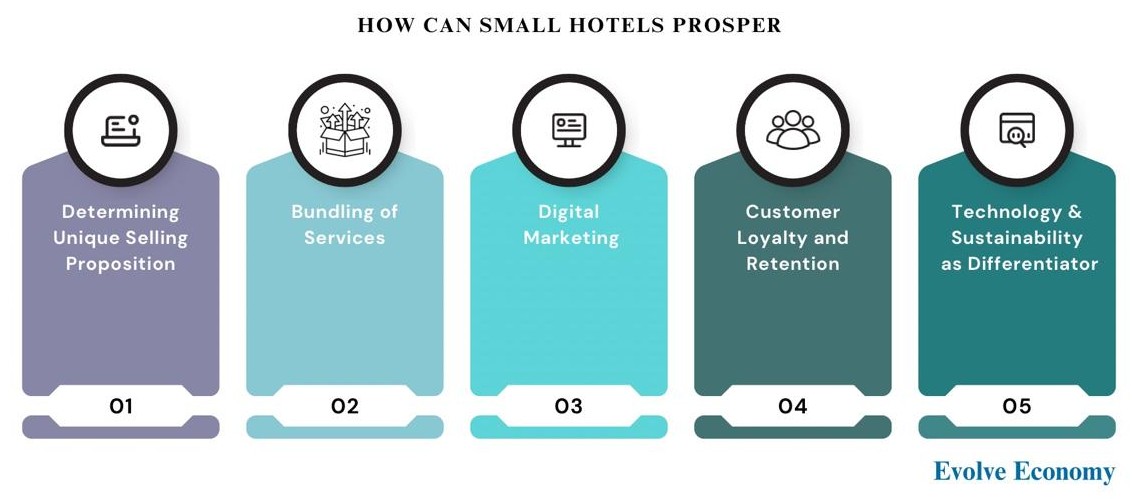

3. Key Strategies for Small Hotels

Hotels operate on a model with high fixed costs, making higher sales key to cost recoverability. While the cost structure remains broadly constant, hotels can optimise expenses and drive higher revenue by leveraging the following strategies.

4. Determining USP

4.1 Problem

- Branded hotel chains flourish because of their ability to build trust amongst their audience by delivering superior quality service.

-

The problem with small hotels is their

inability to curate quality customer experience as the focus lies solely on customer acquisition.

4.2 Solution

- While it is difficult to compete on luxury parameters due to capital constraints, small hotels should focus on what big hotels cannot provide.

-

By developing

USPs like strategic location, personalised customer experiences and free cancellations, small hotels can steal the game. - They can do so by focussing on local partnerships, location advantages and tweaking pricing models.

- Small hotels can also develop their unique proposition by catering to a particular niche of customers, like hostel stays for solo travellers or premium stays for business people.

4.3 Actionable

- Small hotels can benchmark their key metrics with competitors to identify the right model and selling proposition.

- Hotels can use the Market Penetration Index (MPI) as a metric to track their occupancy percentage versus that of the market.

- Analysing the competitive landscape can also help in identifying the under-served segment in the industry.

- Analysing ADR around different seasons and service models can help identify the right pricing strategy to capitalise on USP.

Example

Tree of Life Resorts and Hotels has successfully positioned itself as a provider of experiential stays in offbeat destinations across India.

5. Bundling of Services

5.1 Problem

- The service provided by small hotels is basic as the focus is only on stay as a service.

- Big hotel chains focus on customer experience as a service by re-carving the traditional stay as a service model to experience as a model by attaching ancillary services like spas, indoor and outdoor games, and guided tours, to name a few.

5.2 Solution

- Small hotels can also provide bundling of services by driving personalisation and local experiences.

- Personalisation can be in the form of entertaining specific room preferences or special occasions like anniversaries.

- Such personalised services can increase repeat bookings by 20%, leading to boosting annual revenue by 5-10%.

- Incorporating local experiences by offering nature walks, farm-to-table dining, local delicacies, and pet-friendly spaces can help improve the Guest Satisfaction Score (GSS) by 15%.

5.3 Actionable

- Hotels should invest in CRM tools to track guest

- Comparing TRevPAR with ADR can help understand the efficacy of service bundling as a model.

Example

Neemrana Hotels is renowned for restoring historical ruins into heritage hotels, offering guests a chance to stay in architectural marvels like Neemrana Fort Palace and Hill Fort Kesroli.

6. Digital Marketing for Brand Building

6.1 Problem

- With the internet boom, customers tend to rely on brands having good ratings and online presence.

- Small hotel owners have minimal focus on traditional marketing without focusing on building brand online, which can help them leverage premium pricing.

6.2 Solution

- Hotels can adopt inexpensive marketing strategies like showcasing their property online, collaborating with local bloggers and developing user generated content on social media.

- They can encourage guests to give online feedback on websites, Google reviews and social media pages.

- Digital marketing enables visibility as well as direct bookings. Such direct bookings can help saving OTA commissions by 20%

- Direct bookings can be encouraged by providing perks like discounts, complimentary breakfasts or customised check-ins/outs.

6.3 Actionable

- Hotels can allocate appropriate budgets towards marketing campaigns and track their efficiency through KPIs like conversion rates and CAC

- They can further compare the increase in TrevPAR with an increase in CPOR due to marketing spending.

- Guest reviews can help in enhancing overall occupancy rates and TrevPAR.

- Conducting scenario analysis to identify the right strategy that increases customer lifetime value while reducing acquisition cost.

Example

Mount Hotels in Darjeeling and Gangtok effectively leverage their website to highlight unique features, offering direct booking discounts of up to 25% to attract customers.

7. Focus on Guest Loyalty and Retention

7.1 Problem

- Small hotel owners pay little or no attention to developing repeat business from existing customer base.

- Focusing on acquiring new customers only increases acquisition cost, leading to cost inefficiency.

7.2 Solution

- Developing loyalty programs can help boost repeat rate since the cost of acquisition for repeat customers is lower than for new customers.

- Loyalty incentives can be in the form of future discounts or guest-specific special occasions.

- Email marketing can be explored to keep guests engaged with exclusive guest-specific offers.

7.3 Actionable

- Hotels should actively track GOPPAR to ensure the effectiveness of loyalty programs with a decreasing trend in customer acquisition cost.

- Loyalty incentives should be tracked continuously to ensure their financial feasibility and bottom-line impact.

Example

Ahilya Fort in Maheshwar offers various guest-specific offers like last-minute stays, weekend escapes, and stay a little longer packages to retain their guests for a longer time.

8. Technology & Sustainability as Differentiators

8.1 Problem

- Most of the small hotels continue to function without evolving with little adoption of modern technology.

- They see technology integration as a costly affair without analysing the cost savings or new revenue potential.

- While the world is fast moving towards sustainability to tackle environmental challenge, hotels consider sustainability as a cost driver, not a differentiator.

8.2 Solution

- Hotels should invest in budget-friendly Property Management Systems (PMS) for streamlining operations.

- Such PMS can help in cost savings of up to 30% through operational efficiencies.

- Leveraging online booking portals and cloud-based solutions for customer data storage can turn out to be cost-effective.

- By implementing sustainable initiatives like solar panels, waste recycling and rainwater harvesting, hotels can leverage higher premiums of 5-10% from environment-conscious customers.

- Relevant certifications can also be obtained to demonstrate credibility.

8.3 Actionable

- Technological and sustainability investments should be evaluated from an ROI lens by considering their cost savings over capital outlay, payback period and tax benefits.

- Cost savings and higher revenue earnings due to technological upgradation and sustainability measures can be evaluated by tracking CPOR and ADR.

- Hotels can track the Average Rate Index (ARI) that tracks its ADR against that of the market to ensure the premium impact.

Example

Located in Kerala, Spice Village utilises solar energy harnessed on the property to meet 75% of its power consumption needs.

Executing the above strategies and tracking key metrics to ensure their success, small hotels shall have strong reporting systems. It will further lead to strategic decision making.