Index

2.1 Investor Mindset Shift

2.2 Cash Burnouts leading to Failures

3.1 Strategic Concentration before Diversification

3.2 Focus on Unit Economics

3.3 Premiumisation as a Category

3.4 Strategic Customer Acquisition

3.5 Operational Efficiency and Cost Optimisation

4.1 Balancing Growth and Profitability

4.2 Stakeholder Management

4.3 Innovation with Discipline

1. Introduction

India is on the brink of a new dawn as startup founders are now being more celebrated than Bollywood celebrities in India. With startup culture becoming a thing, the ecosystem is evolving more rapidly than ever. What started as a race to chase valuations, with the entire focus on customer acquisition only, has now transitioned into a quest to turn profitable. Investors are no longer writing cheques for startups that don’t exhibit a clear path to profitability.

As per Redseer’s Report on Indian Startup Landscape, the number of unicorns focused on profitability rose 1.5x in 2024 compared with 2022. However, this shift did not come at once but was led by a series of events in the Indian startup industry.

2. What Led to the Shift towards Profitability?

Understanding the reasons that led to this paradigm shift from chasing growth to profitability becomes key as it governs the future of Indian startups

2.1 Investor Mindset Shift

- The global economic uncertainties, leading to geopolitical risks, turned investors conservative towards risks and losses.

- This shift in sentiment is evident in the decline of average deal sizes in 2024, despite a notable increase in deal volumes (1,270 deals in 2024 vs. 880 in 2023, according to Bain & Company’s VC Report 2025).

2.2 Cash Burnouts leading to Failures

- India witnessed the fall of several startups that failed to switch to profitability, despite aggressive growth in revenues and consumer footfall.

- This made the value-conscious investors privy to risks in cash-bleeding business models and shifted their focus towards profitability.

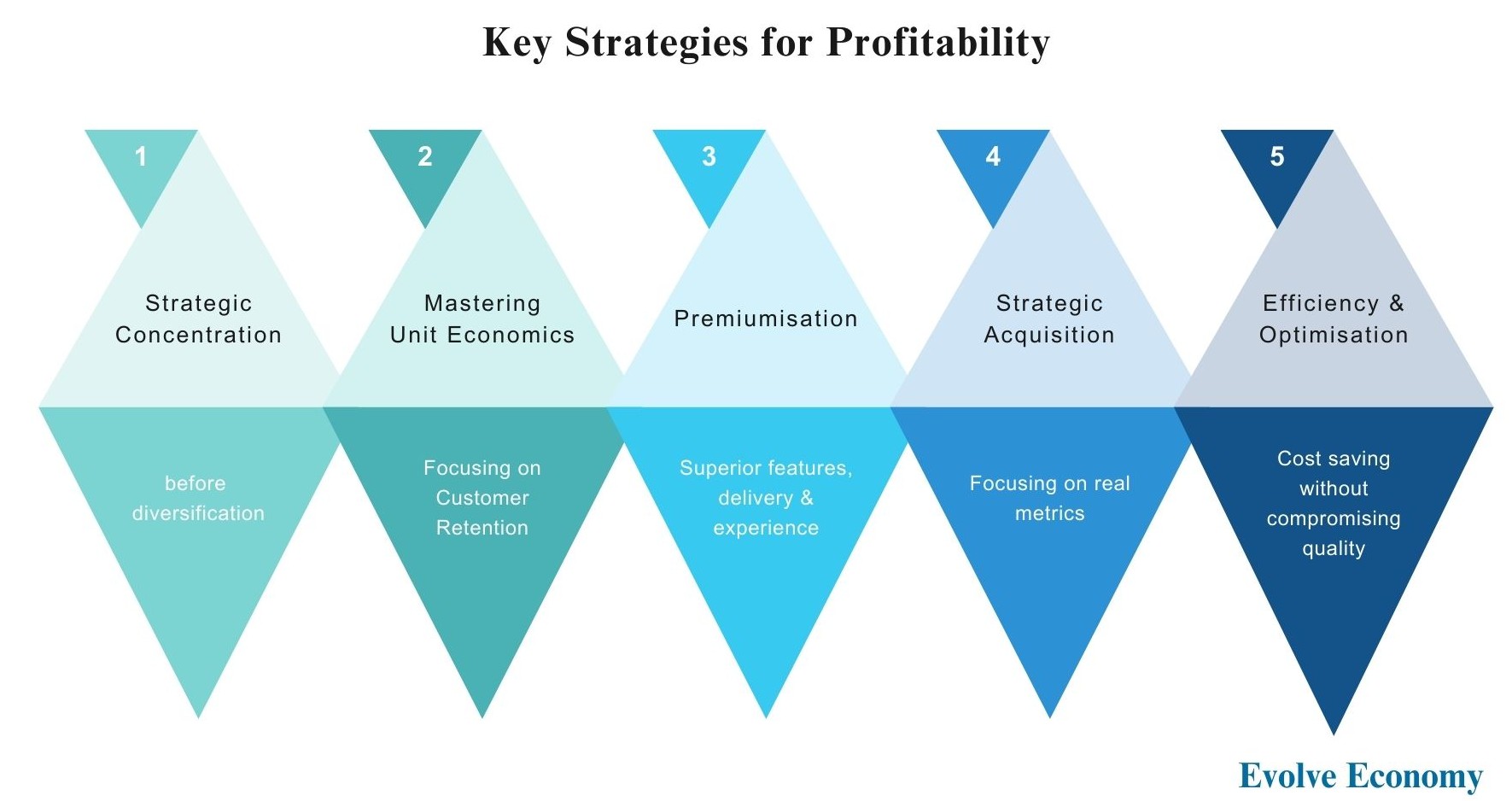

3.Strategies for Startup Profitability

The recent changes in global policies warrant the need for startups to become more resilient by adopting value-driven business models with strong fundamentals. With this focus in mind, this blog dives deeper into key strategies to be adopted by startups for becoming profitable.

3.1 Strategic Concentration before Diversification

- Startups should focus on serving a single product to a small group of customers in the early days when product-market fit has not been established.

- Focusing upon a limited set of products or customers helps in identifying the challenges and misfits well in advance when the stakes are still low.

- This also warrants a more sure-shot chance at success when operations expand.

The best brands often start by doing one thing exceptionally well!

3.2 Focus on Unit Economics

- Gone are the days when customer acquisition used to be the only key.

- Startups need to shift the focus to customer retention as the cost of acquiring new customers is higher than the cost of serving old customers.

- The value generated by one customer over its lifetime association with the business (LTV) should be more than the cost incurred to acquire (CAC)for the startup to witness sustainable growth.

- Thus, startups should focus on pricing strategies and reducing variable costs, overheads and marketing expenses, which help in strengthening the unit economics.

Profitability is not luck. It’s a reward for value delivered!

3.3 Premiumisation as a Category

- Startups should focus on establishing a distinct brand identity and delivering a unique customer experience, which enables them to charge a premium.

- Premium service delivery to the target market can be in terms of

- Superior product features like GoZero’s no sugar desserts for health-conscious buyers

- Superior service, like super-fast deliveries by QCom players.

- Superior experience like Snitch’s focus on Make in India, making consumers feel privileged.

People don’t mind paying more when they feel they’re getting more!

3.4 Strategic Customer Acquisition

- Most of the startups fail because the entire focus lies upon vanity metrics like the number of downloads and online traffic, which show traction but not sales.

- Focusing upon key financial metrics like Customer Acquisition Cost (CAC), Return on Ad Spend (ROAS) and revenue growth helps in achieving profitability.

- Identifying the target market and directing marketing activity towards them helps in streamlining financial health.

Wrong focus drives wrong results!

3.5 Operational Efficiency and Cost Optimisation

- While the above strategies drive topline, it is equally important to control the cost and bottom line.

- Identifying the cost levers and a regular tracking mechanism helps in the identification and elimination of unnecessary expenses.

- Startups should also focus on cash flows, rather than just profitability, to ensure considerable availability of runways for cash expenses.

- Strengthening the supply chain and quality can help reduce customer returns, leading to higher profitability.

- Startups can also explore zero-based budgeting for cost optimisation.

In tough markets, efficiency isn’t a choice. It’s a necessity!

While building a profitable consumer business looks simple, in reality, it can be daunting. Key strategies help in growth, but acknowledging the challenges in advance helps in mitigating risks leading to business failure.

4.1 Balancing Growth and Profitability

- Growth looks fancy. Profitability makes it sustainable.

- Profitability is not anti-growth. It’s the foundation for sustainable growth.

- However, business is not run for small profits, and only growth can bring in justifiable results.

- Thus, both growth and profitability need to go hand-in-hand.

4.2 Stakeholder Management

- Founders want profitability. Investors may push for top-line growth.

- The more the number of stakeholders, the higher the number of expectations.

- The key lies in maintaining a balance.

- Communicating transparently with investors and showcasing plans for future growth can help maintain the trust and balance.

4.3 Innovation with Discipline

- When consumers evolve, brands must evolve too.

- However, chasing innovation without financial discipline can derail the business.

- Innovation must be intentional, sustainable, and aligned with what the brand stands for.

- Plus, all the innovations need to be done keeping in mind the budget constraints.

5. Conclusion

Profitability should not be looked upon as a constraint, but as a driver for growth. While growth can come from short-term hype, profitability vouches for long-term sustainability.

While the rulebook may keep changing, profitability as a fundamental cannot be eliminated. It’s the very base that keeps the business running.

Profitability can be achieved only by focusing on every element of the business. Both revenue and costs impact the profitability equally; thus, looking at one in isolation from the other is dangerous.

Start thinking about profitability today – not as an afterthought, but as part of your core strategy.

And if you’re looking for support on building a brand that’s both loved by users and built to last, let’s get in touch today!