Annual Operating Plan

What is an Annual Operating Plan?

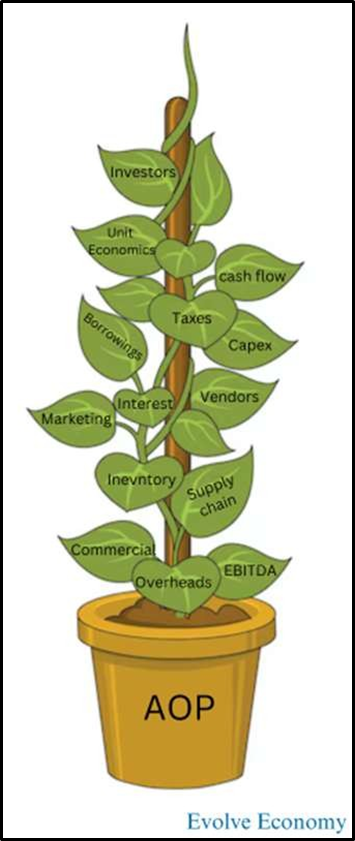

An Annual Operating Plan, or AOP, to a business, is what a moss stick is to a money plant. Without a stick, the plant grows in every direction, but not upwards. AOP is a detailed layout that helps a business chart its roadmap for the coming year, detailing the action plan, resources and milestones necessary to execute the company’s vision. While founders have clarity of goals in their mind, an AOP helps them to draft down their vision formally in a document, which serves as a guiding source to business teams in the event of any uncertainty.

Why should a business have an AOP?

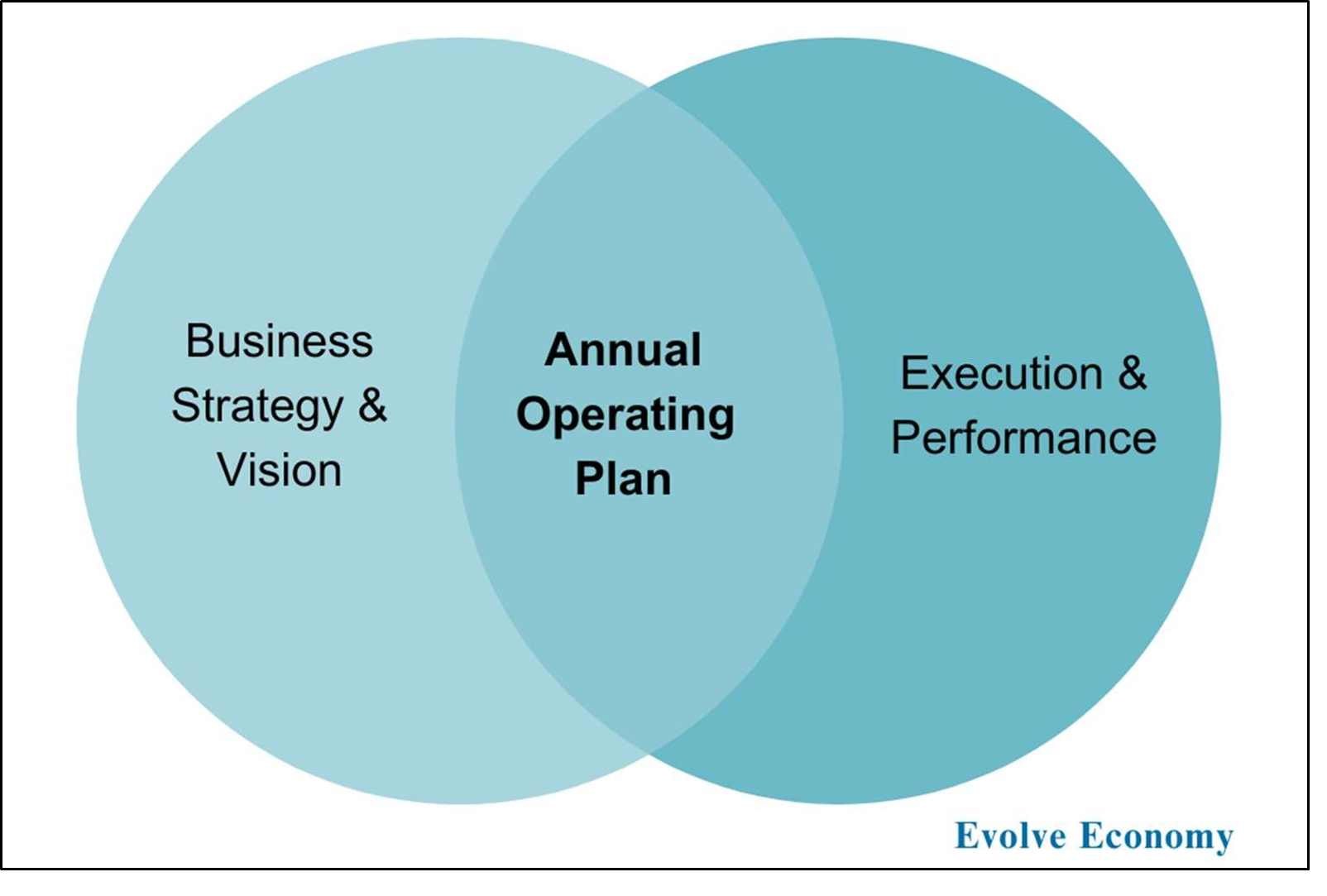

An Annual Operating Plan breaks the long term vision of an organisation into short-term actionable goals for the functional team to move upon. While the vision is broad, AOP is more specific, time bound and action oriented. When the business size expands, an AOP acts as the guiding force for multiple teams to work towards the same direction.

An AOP also helps in

1. Liasioning with Banks and Investors: A well-defined AOP with accurate forecasts for future profitability and cash inflows helps you win funding from investors and banks. It serves as a powerful communication tool to negotiate with the investors better and persuade them.

2. Identification of Risks and Early Mitigation: AOP involves careful evaluation of market volatility that can hamper the business going ahead. Therefore, an effective AOP helps in charting the risks well in advance and developing a go-to-market strategy.

3. Efficient Resource Allocation: When resources are scarce, an effective annual operating plan helps in building equilibrium between various functions and stakeholders keeping the business goals as a base. An AOP helps in identifying key priorities and allocation of limited funds to key business functions.

4. Business Performance Evaluation: For a business to evaluate its performance, it is necessary to have benchmarks in place. An annual operating plan helps measure actual performance in relation to goals set and identify reasons for deviation for corrective action. This further helps in steering the business towards profitable growth in future.

Is AOP necessary for Small Businesses and Startups as well?

It is often argued that a formal business plan is required only in big entities having multiple teams and stakeholders. However, it is equally important for a small business and startup to have a detailed operating plan because

• Business environment uncertainty is higher for startups as they are yet to figure out the market feasibility of their product and services. In such an event, an AOP helps founder revisit their vision and acts as a backup for navigating the way out of difficult business situations.

• Startups have relatively new processes and functions and a binding force is required to keep them working efficiently towards a common direction.

• A well laid out AOP helps startups win the confidence of their investors by showing them financial projections and a detailed plan to effectively manage the cash flows.

AOP Process

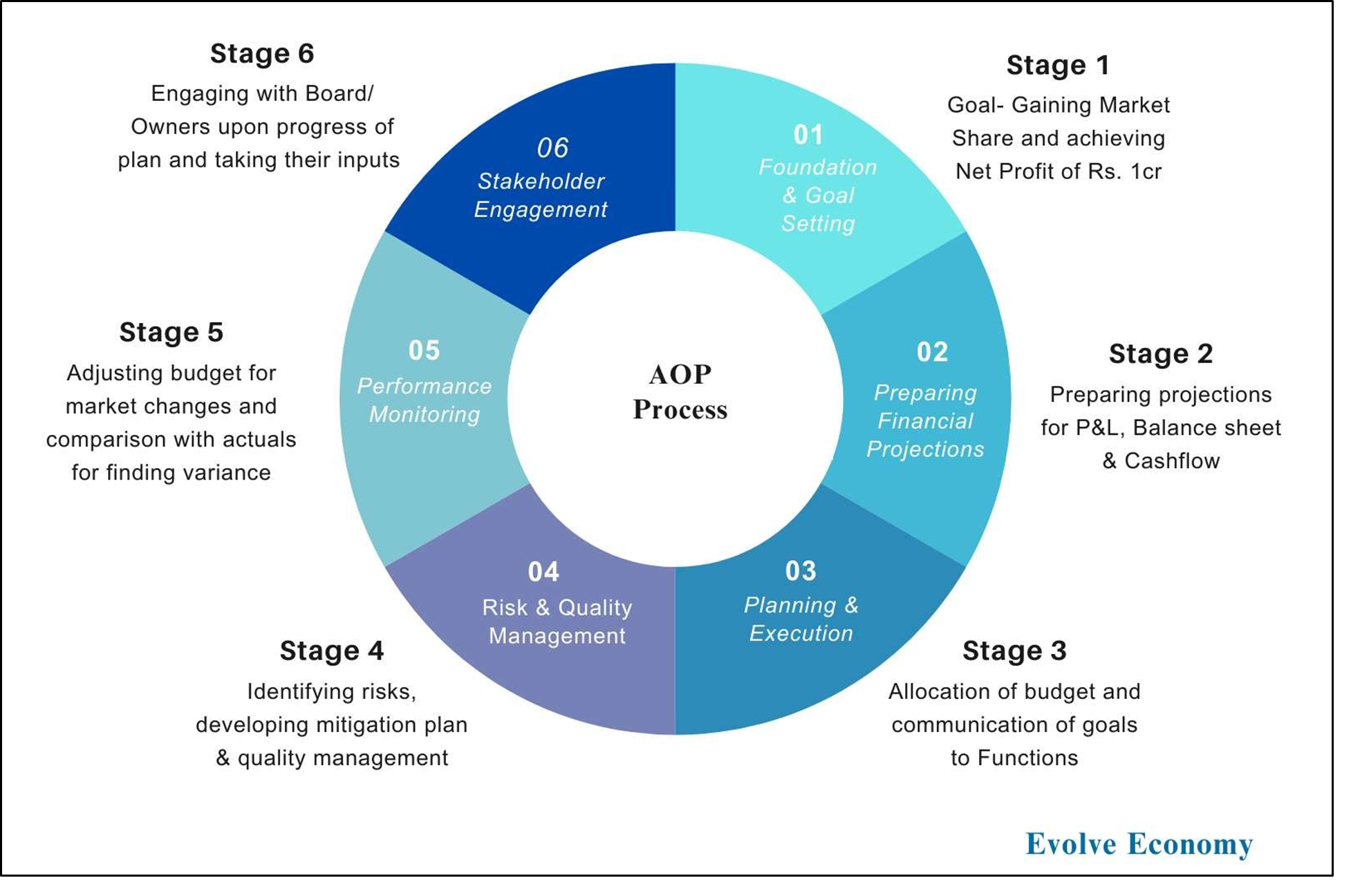

Setting out an Annual Operating Plan is a detailed task as it involves setting the goals basis the vision of the owners, taking the inputs from each function and aligning the same with the overall goals.

In a nutshell, it is a process that requires multiple stakeholders to work together to create a common action plan for the organisation by and large.

The below chart exemplifies the process of setting an AOP and its various stages.

Stage 1: Setting the Foundation

An AOP is a detailed plan to achieve end goals. Therefore, it is important to identify the end goals before laying out the plan for next year. Setting the foundation involves evaluation of the business landscape, analysing market trends, competitive positioning, and internal capabilities.

Stage 2: Developing Financial Projections

This is the crucial part as it involves preparing budgeted financial statements in line with the goals set. As a part of the process, each function submits its projections and consolidated financials are made out of it using a bottom-up approach. It is pertinent to note that AOP should set quantifiable targets to be achieved within the designated timeline.

Stage 3: Resource and Execution Planning

This step involves the distribution of human, financial and other resources amongst goals and functions. When resources are limited, it is important to identify key areas that are crucial to a business’s growth and resources should be allocated accordingly.

Stage 4: Risk Management and Mitigation

Once the budget is set, it is crucial to identify potential risks like competitor policies and changes in government regulations that could adversely affect the business. If required, the plans should be adjusted for changes in external market conditions.

Stage 5: Performance Monitoring

This step involves comparing the actual performance with the budget set to identify deviations and take corrective action. Deviations could be due to uncontrollable market factors or internal inefficiency. While external factors are uncontrollable, it is crucial to identify internal gaps and rectify them.

Stage 6: Stakeholder Engagement

The AOP should be approved by the owners, board and other stakeholders of the company. This offers oversight and governance, ensuring the plan is in line with organisational objectives and risk tolerance. At the end of the cycle, the comparison of actual results with AOP gives stakeholders an idea of the future direction of the business.

Does AOP need any revision?

Ideally, once an operational plan is finalised, it shouldn’t be modified. However, changes in the external environment could significantly affect the validity of the assumptions taken to make a plan. In such cases, AOP should be revised and communicated to internal teams.

Also, monthly business targets laid out in the plan should be adjusted for changes in external factors that are beyond control through forecasting for effective comparison with actual performance.

Factors to keep in mind before finalising AOP

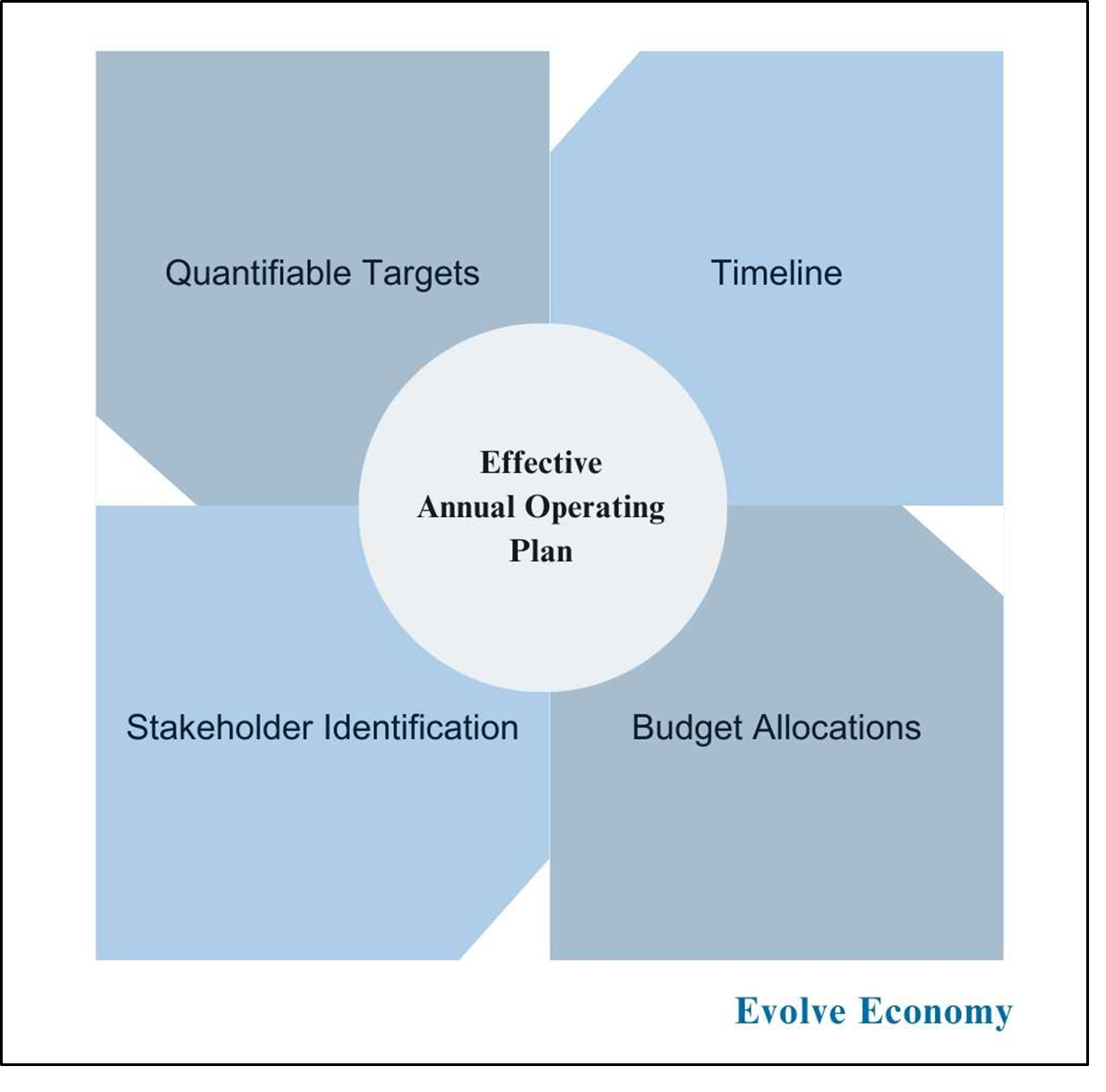

Below are some key factors to be kept in mind before finalising the annual operating plan for the year. An AOP will be effective only when:

• Targets are quantified and can be reliably measured

• Funds are allocated and functional ownership is identified

• Timelines are clearly defined and communicated to the team

• AOP should be flexible to accommodate change events

• Targets should be realistic and based on past experiences and current business scenarios

Has your organisation prepared an AOP, or is one currently in development? Regardless of your status, assessing your plan against this framework can reveal valuable opportunities for improvement. If you need any guidance during this process, you can always get in touch with us!